CHINA'S ECONOMY: CHINA'S THE WORLD'S TOP EXPORTER, THE NEW SECTORS TO DRIVE CHINA'S ECONOMIC GROWTH, CHINA'S REAL ECONOMY HAS ALSO DECREASED WITH $19 TRILLION IN STATE ASSETS,HERE IS HOW CHINA COULD DIFFUSE IT'S MASSIVE DEBT.

China is the largest export economy in the world. China

has 1.37 billion people, more than any other country in the world.

China is still a relatively poor country in terms of its standard of

living. Its economy only produces $15,400 per person, compared to the

U.S. GDP per capita of $57,300.The low standard of living allows

companies in China to pay their workers less than American workers. That

makes products cheaper, which lures overseas manufacturers to outsource

jobs to China.

China is the largest export economy in the world. China

has 1.37 billion people, more than any other country in the world.

China is still a relatively poor country in terms of its standard of

living. Its economy only produces $15,400 per person, compared to the

U.S. GDP per capita of $57,300.The low standard of living allows

companies in China to pay their workers less than American workers. That

makes products cheaper, which lures overseas manufacturers to outsource

jobs to China.

China’s emergence as a great economic power has induced an epochal shift in patterns of world trade. Simultaneously, it has challenged much of the received empirical wisdom about how labor markets adjust to trade shocks. Alongside the heralded consumer benefits of expanded trade are substantial adjustment costs and distributional consequences. These impacts are most visible in the local labor markets in which the industries exposed to foreign competition are concentrated. Adjustment in local labor markets is remarkably slow, with wages and labor-force participation rates remaining depressed and unemployment rates remaining elevated for at least a full decade after the China trade shock commences. Exposed workers experience greater job churning and reduced lifetime income. At the national level, employment has fallen in U.S. industries more exposed to import competition, as expected, but offsetting employment gains in other industries have yet to materialize. Better understanding when and where trade is costly, and how and why it may be beneficial, are key items on the research agenda for trade and labor economists.China built its economic growth on low-cost exports of machinery and equipment. Massive government spending went into state-owned companies to fuel those exports. These companies dominate their industries. They include the big three energy companies: PetroChina, Sinopec and China National Offshore Oil Corporation. These state-owned companies are less profitable than private firms. They return only 4.9 percent on assets compared to 13.2 percent for private companies.China developed cities around these factories to attract workers. As a result, one-fourth of China's economy is in real estate. The government also funded construction of railways and other infrastructure to support growth. China is the largest export economy in the world. In 2016, China exported $2.06T and imported $1.32T, resulting in a positive trade balance of $736B. In 2016 the GDP of China was $11.2T and its GDP per capita was $15.5k.The top exports of China are Computers ($136B), Broadcasting Equipment ($115B), Telephones ($84.3B), Integrated Circuits ($54.8B) and Light Fixtures ($29.7B), using the 1992 revision of the HS (Harmonized System) classification. Its top imports are Integrated Circuits ($128B), Crude Petroleum ($116B), Gold ($62.6B), Iron Ore ($58B) and Cars ($44B).The Industry is 72.8% of China’s gross domestic product (GDP) . Industry (including mining, manufacturing, construction, and power) contributed 46.8 percent of GDP and occupied 27 percent of the workforce . As of 2015, the manufacturing industrial sectors contribute 40% of China's GDP. The manufacturing sector produced 44.1 percent of GDP and accounted for 11.3 percent of total employment . China is the world’s leading manufacturer of chemical fertilizers, cement, and steel.Chinese industrial companies, most of which are medium to large cap. Top holdings including: Weichai Power, Anhui Conch Cement Company, and China National Building Material. CHII's sector breakdown includes: 63% industrial materials, 25% business services, and 12% consumer goods. Over the past decade Chinese industry and manufacturing sectors have seen unpredicented growth. As China positions itself as the world's manufacturing center, and with still more room to grow.

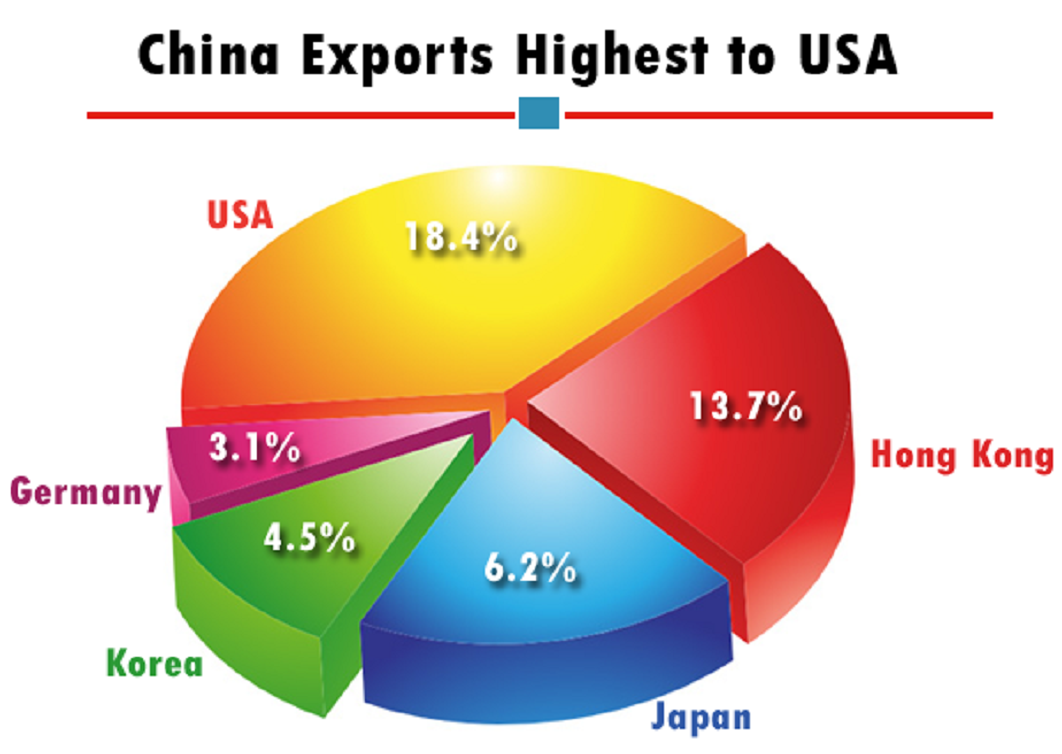

China export to various

foreign countries across the world as it rank top in global exports. China is a

global hub for manufacturing. It is the largest manufacturing economy in the

world and largest exporter of goods around the globe. United States of America

and Hong Kong are the main markets for China Export Industry. United States

received shipment of USD 385 billion from China in 2016 and it represents 18.4%

of the total value of China exports. Do you know ‘what does the US import from

China’? Let’s check the list of China exports to USA as mentioned below.

China export to various

foreign countries across the world as it rank top in global exports. China is a

global hub for manufacturing. It is the largest manufacturing economy in the

world and largest exporter of goods around the globe. United States of America

and Hong Kong are the main markets for China Export Industry. United States

received shipment of USD 385 billion from China in 2016 and it represents 18.4%

of the total value of China exports. Do you know ‘what does the US import from

China’? Let’s check the list of China exports to USA as mentioned below.

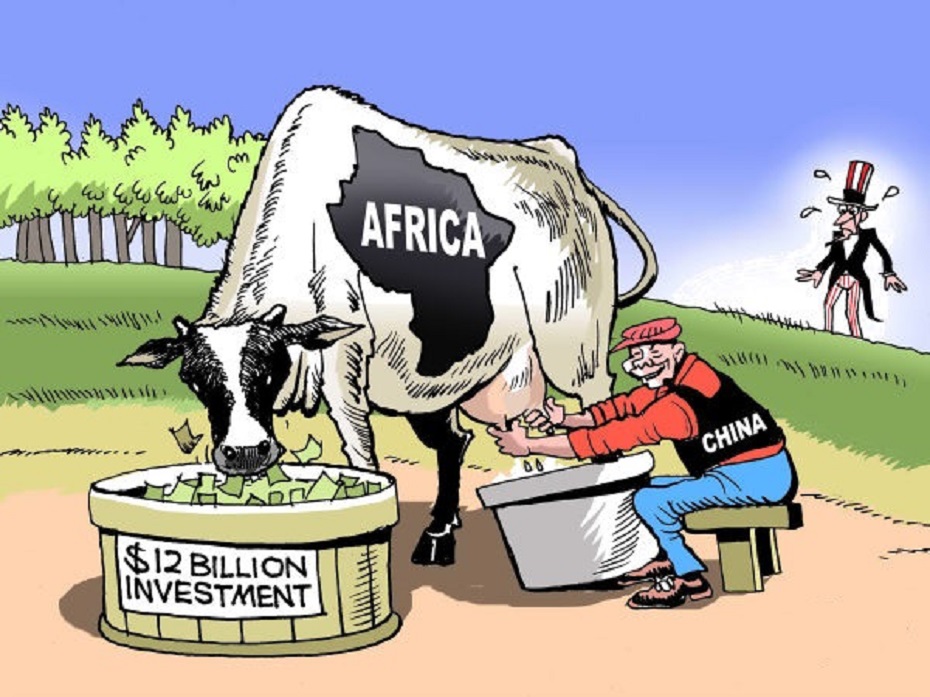

China’s economy has always depended heavily on investment into fixed assets such as roads, railways and apartment complexes. But over the past decade, as cheap exports’ share of the economy has collapsed and as household consumption has continued to slide, this investment has become one of the primary drivers of economic growth and employment in China and, by extension, a cornerstone of its stability.That much of China’s fixed asset investment comes from the country’s biggest state-owned banks (including the “Big Four,” which answer directly to Beijing) not only highlights its importance as a policy tool but also explains why Chinese leaders have wielded it so liberally to offset weaknesses in other areas of the economy.Of course, the funds for such ample investment have to come from somewhere, and over the years Beijing has gotten them through many different means. From slashing benchmark interest rates and bank reserve requirements to boosting domestic equity markets and direct spending, the Chinese government has paid for its purchases in several ways. The largest trading nation and the most popular destination of foreign direct investment in th e world. Many economists are optimistic about China’s growth potential China is set to surpass the U.S. as the leading economy in a decade. The Chinese growth miracle started with agriculture in the late 1970s. The essence of the reform was collectivization of agricultural production and land user rights . The most important part of the reform was officially called the household responsibility system (HRS). HRS granted farmers land cultivation rights and empower them to make their own production decisions. With better aligned incentives, agricultural production and rural incomes witnessed a dramatic increase in the ensuing years. During the first period of HRS implementation between 1978 and 1984, output in the Chinese agricultural sector increased by more than 61% and HRS accounted for 49% of the output growth . In a few years, hundreds of millions of farmers were released from their land, providing the nonfarm sector with a seemingly unlimited l abor supply.Economic relations between China and Africa, one part of more general Africa–China relations, began centuries ago and continue through the present day. Nowadays, China seeks resources for its growing population, and African countries seek funds to develop their infrastructures.China has become Africa’s largest trade partner and has greatly expanded its economic ties to the continent, but its growing activities there have raised questions about its noninterference policy. Over the past few decades, China’s rapid economic growth and expanding middle class have fueled an unprecedented need for resources. The economic powerhouse has focused on securing the long-term energy supplies needed to sustain its industrialization, searching for secure access to oil supplies and other raw materials around the globe. As part of this effort, China has turned to Africa.

How do Africans view China's economic presence on the continent? The

latest Afrobarometer survey reports that on average, 63% of Africans

surveyed believed China to be a "somewhat" or "very positive" influence

in their countries while "only 15% see it as somewhat/very negative.

How do Africans view China's economic presence on the continent? The

latest Afrobarometer survey reports that on average, 63% of Africans

surveyed believed China to be a "somewhat" or "very positive" influence

in their countries while "only 15% see it as somewhat/very negative.